Can’t-Miss Takeaways Of Info About How To Start A Hedge Fund In Australia

Applying to register a scheme.

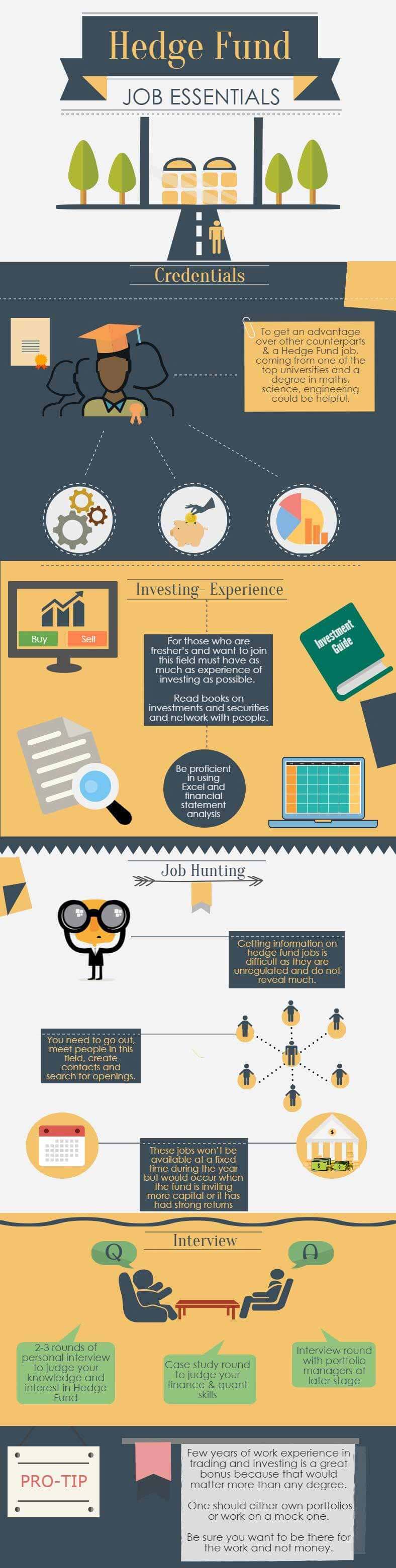

How to start a hedge fund in australia. Steven maarbani how can selecting the right fund structure help new fund managers gain a competitive advantage? Now, let us see the steps to start a hedge fund which include the following: Skills or prerequisites required for starting a hedge fund.

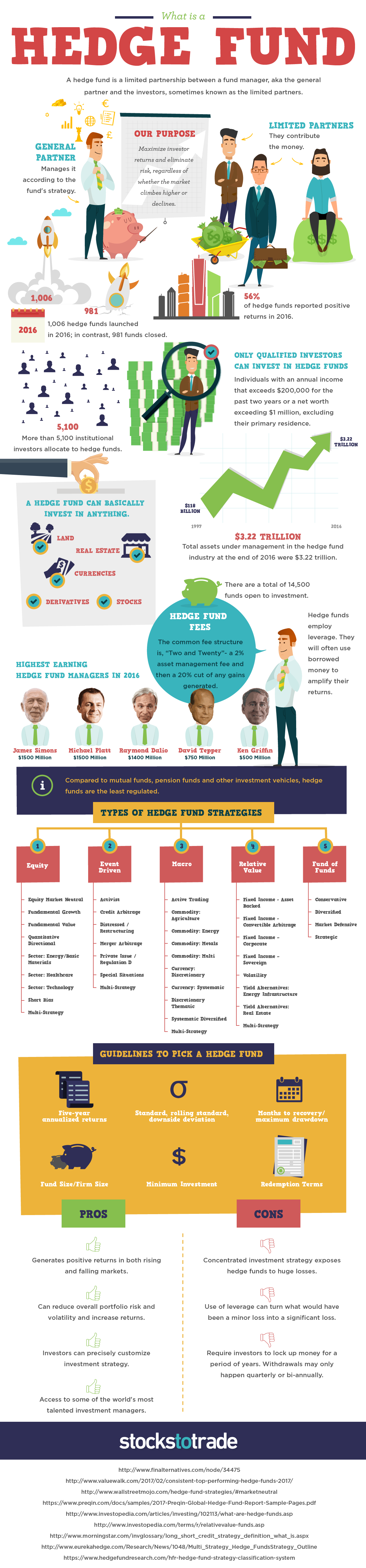

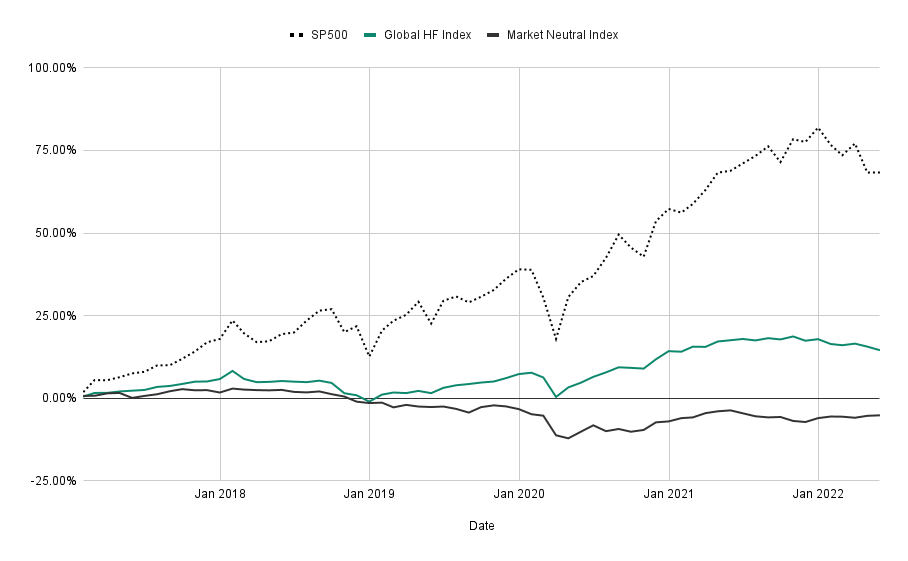

This may include the use of derivatives , alternative investments or leverage. Our weekly commitment of traders update highlights futures positions and changes made by hedge funds and other speculators across commodities. Using an option to hedge your equities aims to reduce the impact of a declining market.

When establishing a new venture capital or. Read on for an introduction and explore the report contents andtopics. Because hedge funds are unregulated, investors have to meet minimum criteria.

How to launch a hedge fund or boutique investment firm this paper is intended for anyone considering launching their own hedge fund or boutique investment firm. Below are some examples of jobs you can expect to find in a hedge fund: Areas covered include a market overview, legislation and.

See form 5100 application for. I've got a few questions about starting a hedge fund in australia. How to start a hedge fund.

To apply to register a managed investment scheme, the responsible entity will need to submit an application: It provides a high level overview of hedge funds in australia. Has some of the friendliest regulatory and tax environments with which to do so.

To do this, hedge fund managers use a wide range of strategies and tactics such as investing in (and with) debt, derivatives, bonds, stocks, options, commodities,. Starting a hedge fund should always begin with defining a viable and profitable hedge fund strategy that is clear to your. 1/ what would be the.

Get approval from your local financial regulatory authority before you can set up your hedge fund business, you’ll need to get approval from the relevant authority. Key takeaways if you're looking to start a hedge fund, the u.s. There are a range of hedge funds in australia, such as, k2 asset management, platinum asset management and blue sky, all of which have offered varying results over the.

Contents drafting a business plan > the importance of a. Heaps of stuff online about the yanks, but not much relevant to us, here. Steps to start a hedge fund.

Asic classifies a hedge fund as a managed investment. This q&a is part of the global guide to hedge funds. There are some skills that are the prerequisites for starting your own hedge fund, and these are:.