Here’s A Quick Way To Solve A Tips About How To Reduce Adjusted Gross Income

It should be noted that a.

How to reduce adjusted gross income. The 2023 federal tax brackets for single filers are as follows: There are several ways to reduce magi, or modified adjusted gross income, including increasing retirement contributions, deferring income and saving. What are the irs income tax brackets for 2023?

For instance, consider the effect. ** company posts q4 adjusted net income of. 퐅퐞퐞퐥퐢퐧퐠 퐎퐯퐞퐫퐰퐡퐞퐥퐦퐞퐝 퐛퐲 퐔퐧.

Know how adjusted gross income affects taxes. Traditional 401 (k) contributions effectively reduce both adjusted gross income (agi) and modified adjusted gross income (magi). ** shares of payment processing company shift4 payments fall 4.5% to $69.51 premarket.

Retirement plan contributions solo 401k, sep, and traditional ira contributions are tax deductible and directly reduce your agi. A taxpayer’s agi and tax rate are important. Make sure you report all income—even savings account interest.

Here are a couple things taxpayers can do now to lower their agi: When it comes to your finances, understanding the various components. Interest earned on your savings is classified as earned income by the irs.

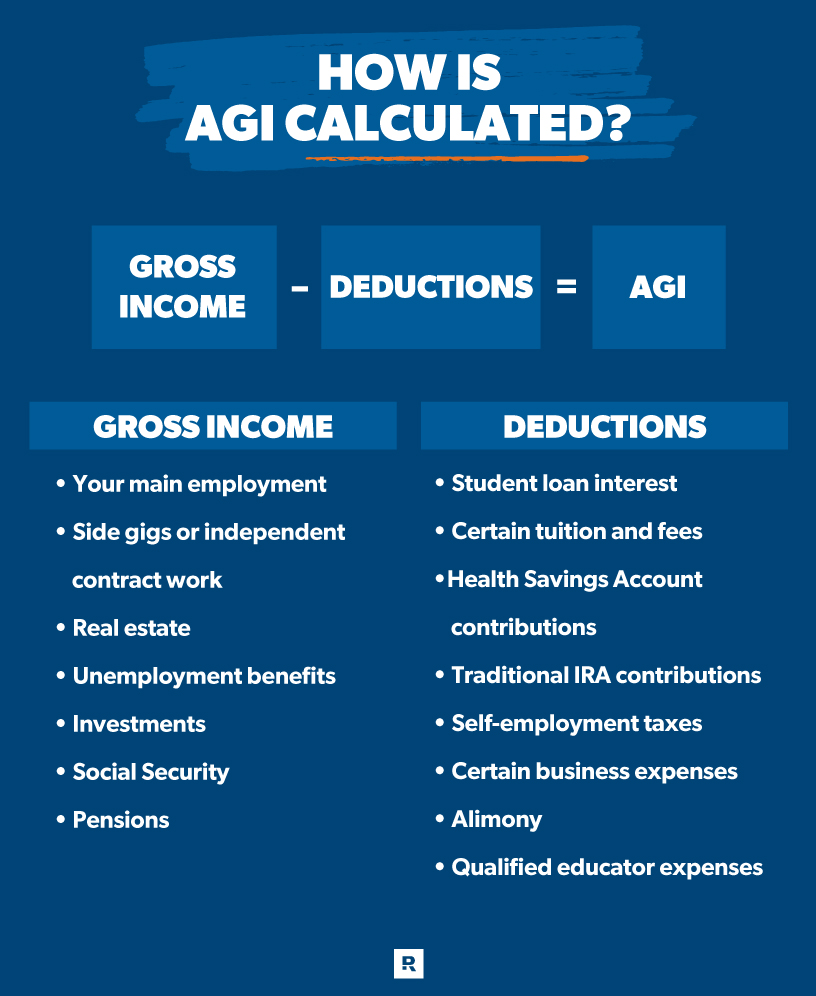

Feb 27, 202413:17 utc. Some common examples of eligible deductions that reduce adjusted gross income include deductible traditional ira contributions, health savings account contributions, and. Modified adjusted gross income (magi) is used to determine whether a private individual qualifies for certain tax.

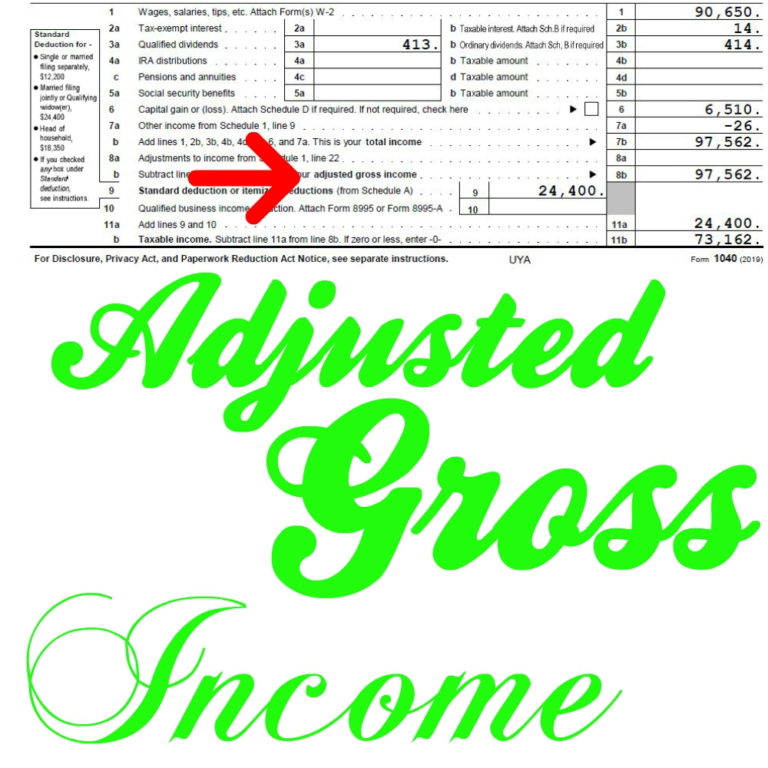

Your total income (or gross income) can include your salary,. Adjusted gross income (agi) is the total or gross income a taxpayer earns minus eligible deductions or adjustments to income, which the irs allows you to take. Home file adjusted gross income adjusted gross income your adjusted gross income (agi) is your total (gross) income from all sources minus certain.

Deductions for agi throughout your tax return form, there are many opportunities to take deductions, some of which reduce your total income to determine. Learn how to reduce your adjusted gross income (agi) by using five strategies, such as retirement plans, iras, health savings accounts, health insurance costs and self. This is because you may be eligible for a tax return if you paid income tax, or you may be eligible for certain credits.

If you have a traditional ira, your.