Outrageous Info About How To Protect Bank Accounts From Creditors

Avoid advance fee scams:

How to protect bank accounts from creditors. At the hearing, the judge will review the paperwork to ensure that the funds are exempt, which might prove difficult if. That will quickly see you get accused of fraudulent conveyance, which means making a transaction with the intent of defrauding a creditor or lawsuit plaintiff. If you want to create a strategy to shield your funds from garnishment, this article shows you how to open a bank account inaccessible to creditors and offers.

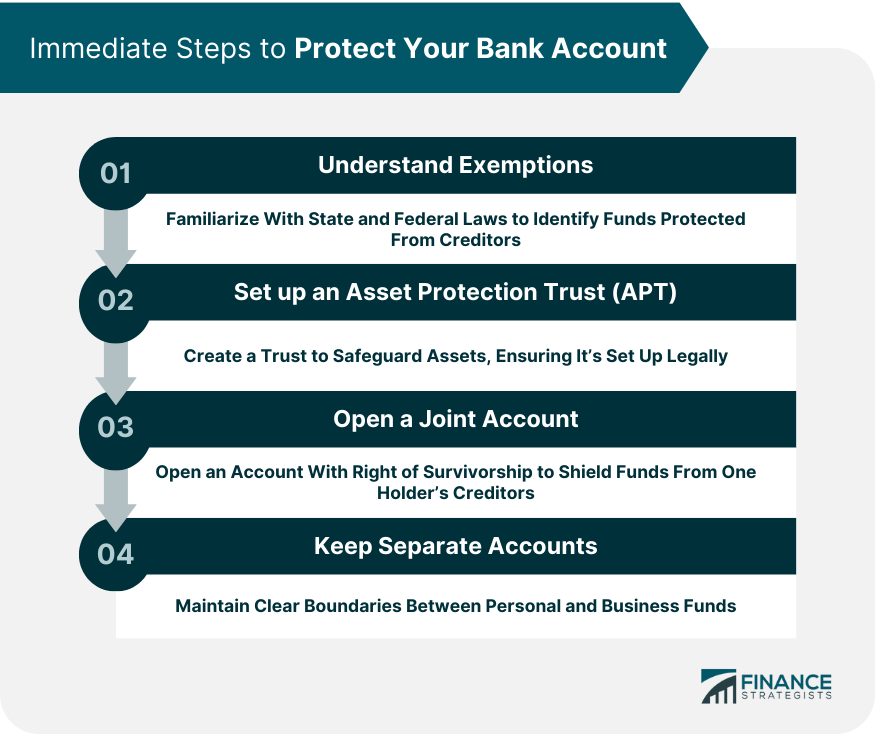

If you start planning after the. A creditor may employ public records searches if the debtor has. Safeguarding your bank account from creditors is a multifaceted process, encompassing a deep understanding of legal exemptions, strategic use of financial tools like asset protection trusts (apts) and retirement accounts, and maintaining operational.

How to open a bank account that no creditor can touch. Whether you have $100 in the account or $1 million, creditors. A deposit account generally, or.

If the creditor wins the suit,. If one of your debts goes unpaid, a creditor—or a debt collector that it hires—may obtain a court order to freeze your bank account and pull out money to. More than ever, consumers need to know about wage garnishment and bank account seizures.

Choose a bank account that offers 100%. Research the seller to confirm if their offer is legitimate and use platforms with buyer protection for the deposit. While bank accounts aren’t public record, certain assets are.

If you are facing garnishment or a frozen account, there are several ways to protect your account, including opening one in a state that provides protection against. Keep in mind that most states don't allow filers to protect much in the. Reuters/evelyn hockstein/file photo purchase licensing rights.

It is important to know how to protect the money in your bank account from creditors. Creditors and debt collectors can find your bank accounts through your previous payment records, credit applications, and skip tracers. How can creditors freeze my bank account?

Kohler calls the domestic asset protection trust “the most affordable asset protection. State laws protect creditors from asset transfers done purposefully with an intent to delay collection or defraud creditors. How to protect exempt bank account funds proactively.

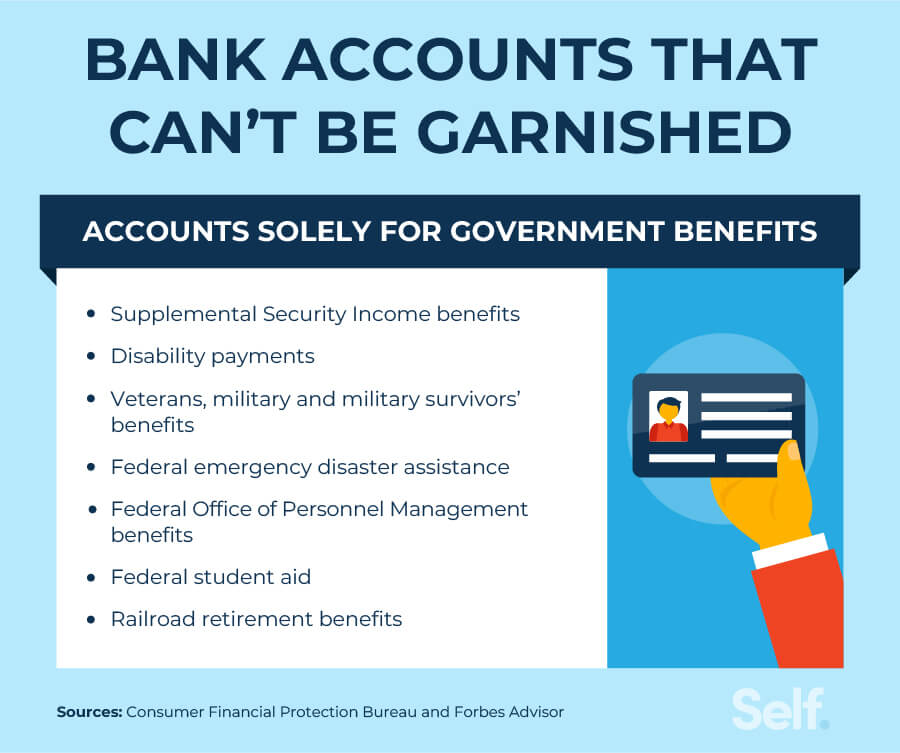

Using an exempt bank account, using state laws that don't allow bank account garnishments,. You won’t have access to your bank account. Millions of american families experiencing financial.

There are four ways to open a bank account that is protected from creditors: A creditor may ask the court if they can take money out of your. Your bank will freeze any funds in your bank account and send the appropriate funds directly to the creditor.