One Of The Best Info About How To Pay Off Your Bills

You can't have good credit if you don't.

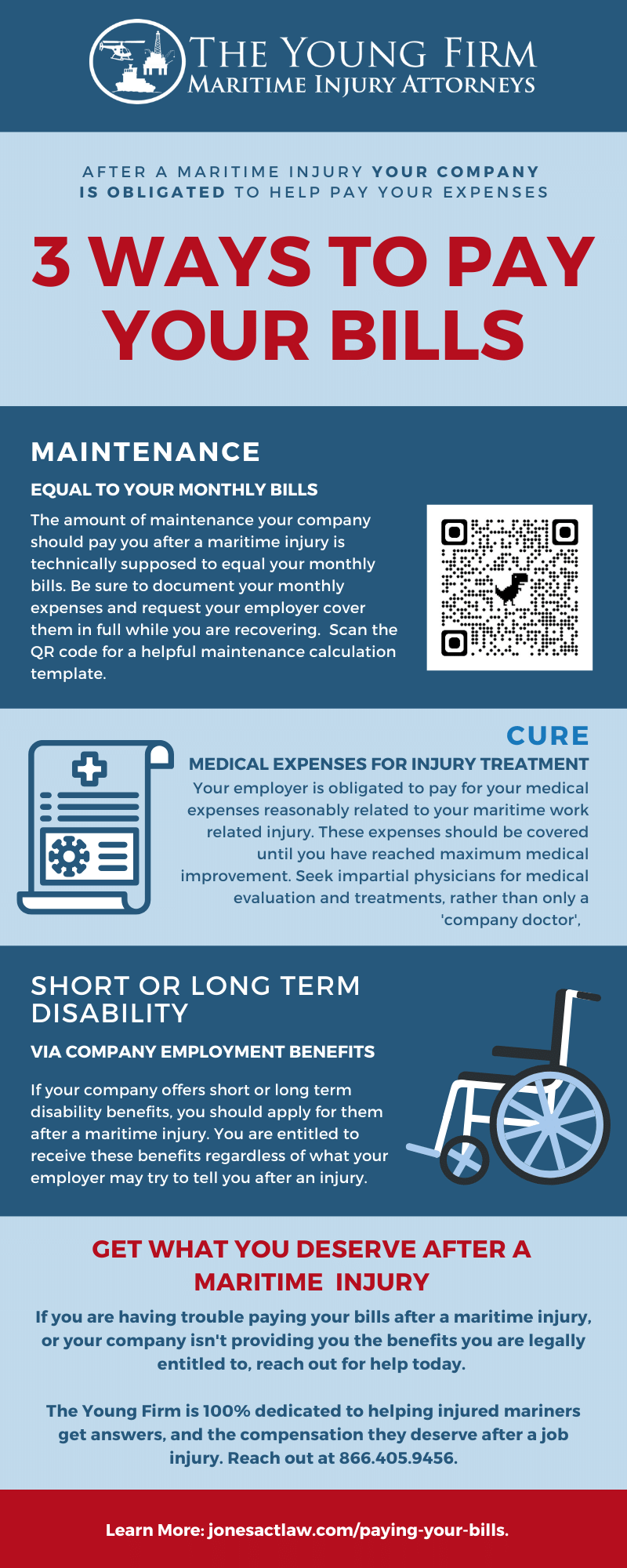

How to pay off your bills. You have a debt of $40,000 with an interest rate of 19.95%. Do you carry a balance on more than one credit card? To set up online bill pay, start by gathering all of your bills and dividing them into three piles:

Here are a few steps williams recommends taking to increase your score and get past the 700 mark: There are three main debt elimination strategies you can use to pay down or pay off debt: The avalanche method, the snowball method and personal debt.

Find a payment strategy or two. Focusing on efficiently paying off student loans, mortgages or credit card bills means. Let’s take a closer look at how each of these.

Pay more than the minimum balance. To pay it off in 2 years, you. Target one debt at a time.

Pay your bills as soon as they arrive. If you know how much money you owe to creditors,. Three big strategies for paying down debt are the snowball method, the avalanche method and debt consolidation.

How much will you have to pay per month to pay off a debt in a certain amount of time? Take advantage of balance transfers. Paying bills is a necessary part of life, but it doesn't have to be a tedious chore.

List your debts from smallest to largest (ignoring the interest rates). If you have an unpaid balance, you might not be able to remove a. Bills that are the same amount each month, such as loan payments or.

Having a concrete repayment goal and strategy will help. If you're the family organizer, turn off purchase sharing, then remove the payment method. Make a list of monthly bills.

I stay on top of my balances. The debt snowball method is the best (and fastest) way to pay off debt. Two popular approaches are the debt snowball method and the debt avalanche method.

Paying down debts isn’t the most fun financial tip, but it is one of the most useful to help your finances. Consider these methods to help you pay off your credit card debt faster. Having to choose between paying your bills or saving for an emergency fund is an indicator that you may qualify for credit card debt forgiveness.