Outrageous Tips About How To Control Personal Finances

2 using a personal finance app.

How to control personal finances. Cancel any monthly expenses that aren't. financial education | britt & la on instagram: Make you money matter more with an post money manager, the budgeting tool that lets you link all your accounts and keep tabs on your spending all in the one place, no matter who you bank with. Fact checked by ariana chávez.

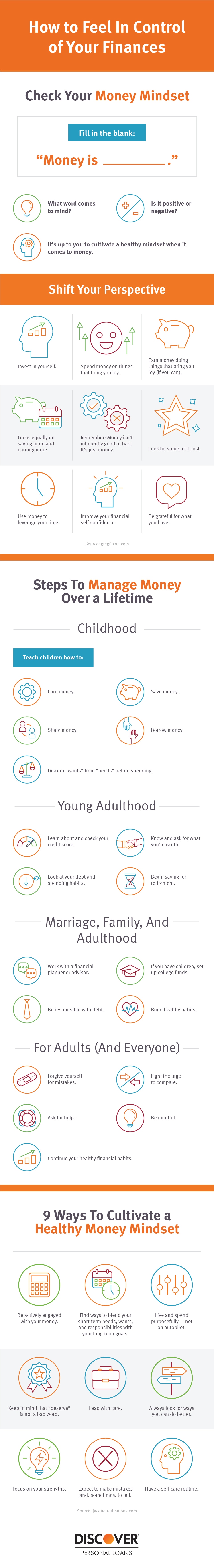

Don’t be afraid to ask for advice. Personal finance is important because it deals with four very critical stages of managing your lifestyle security: There's a few simple steps that will help you get control over your finances.

This means gathering all of your financial documents, such as pay. Automating your bills, savings, and budget can help you go from manually managing your money to having your finances manage themselves. Personal finance expert alisa barcan answers our questions.

5 easy ways to take control of your personal finances. In this free online course, study how to break free from living paycheque to paycheque. Consider factors like cost and the ability to.

Build a money management blueprint 3. Here are 20 ways to have more control of your finances: So, how do you get started on your personal finance journey?

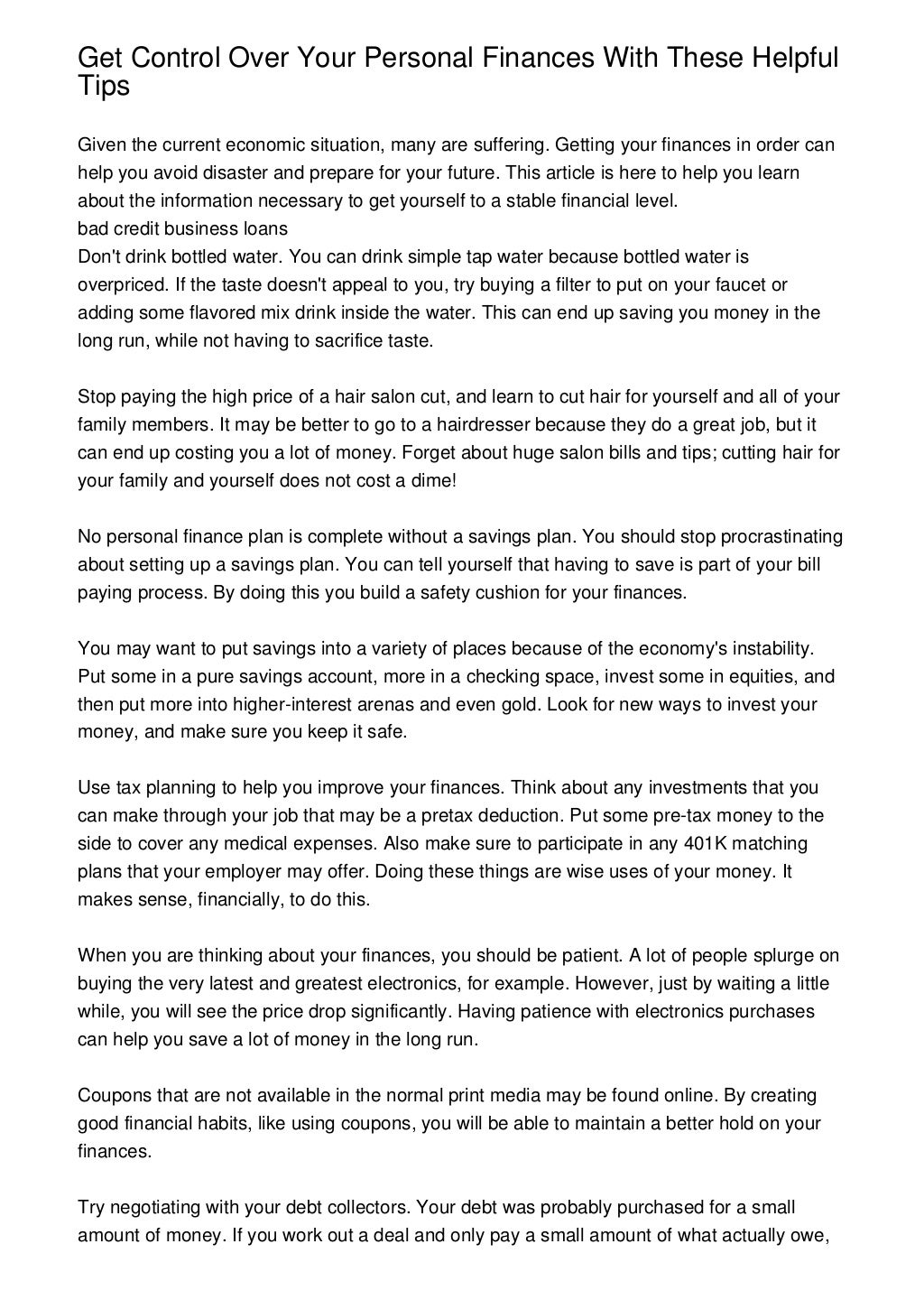

Eliminating limiting beliefs is a crucial step toward mastering your financial life. These can include making a budget, creating a debt payoff plan, and making smart decisions about saving. How to take control of your finances.

Use these tips to get help with your finances today. What can you do to feel in control of your money during a crisis? Your main focus should be on increasing your income.

Don’t let your finances stress you out to the point of inaction. January 16, 2024 fact checked. Updated on october 30, 2021.

What’s an easy win to take control of your finances? How to take control of your personal finances. If you want a better handle on your personal finances, then the following tips will help you achieve that goal.

Make and stick to a budget. Budget your money, figure out your credit score, and learn how to get out of debt using the best personal finance apps. A budget starts with an inventory of your income and where you’re spending it.