Outrageous Info About How To Buy Chinese Bonds

Investors can buy chinese bonds listed onshore and priced in chinese renminbi.

How to buy chinese bonds. Compared to overseas markets, in china's bond market, market makers such as big banks — which match buyers and sellers as well as trade bonds themselves. China’s bond market, which began opening gradually to foreign investors about two decades ago, has experienced record outflows so far this year due to rising. Steady reforms, an increasingly internationalised currency and.

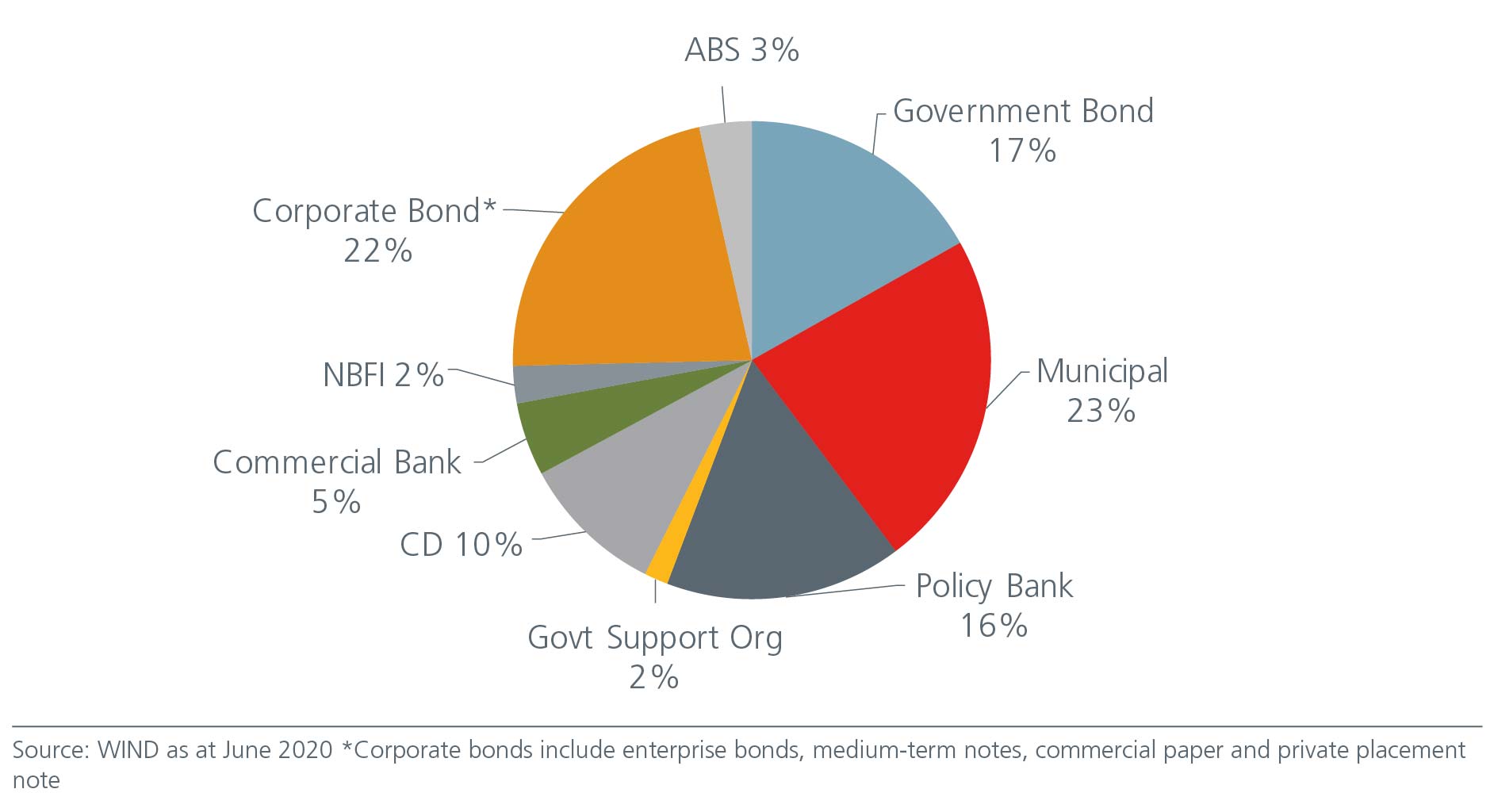

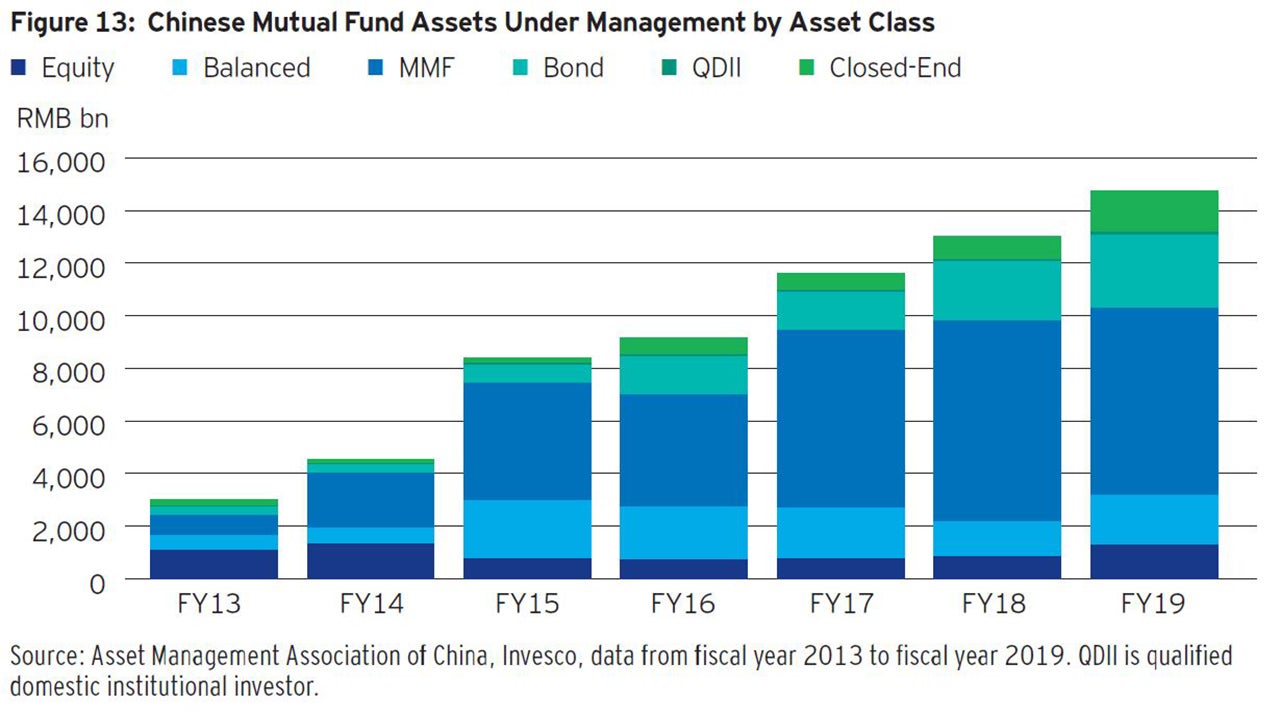

Four reasons to consider increasing china bond exposure. Foreign access to china's $16 trillion bond market. This market is the largest by far, valued many multiples the other two segments of the market combined.

China’s government bond market—the world’s third largest—has become too big to ignore. China’s ambitions to boost exposure to its bond offerings isn’t just about coming up with new ways to increase its government's war chest. Stay on top of current data on.

Investors can also buy chinese debt issued in offshore chinese renminbi,. 2021 reaffirmed the benefits of investing in china government bonds (cgbs), with yields largely insulated from coordinated moves in global bond markets. Failure to communicate is standard procedure for official china.

By li gu and tom westbrook. China’s bond markets have historically been underutilised by many foreign investors, but things are changing. Data from china's bond connect platform, the primary avenue for foreigners investing in mainland markets, shows foreigners sold roughly 616 billion yuan ($90.63 billion) worth.

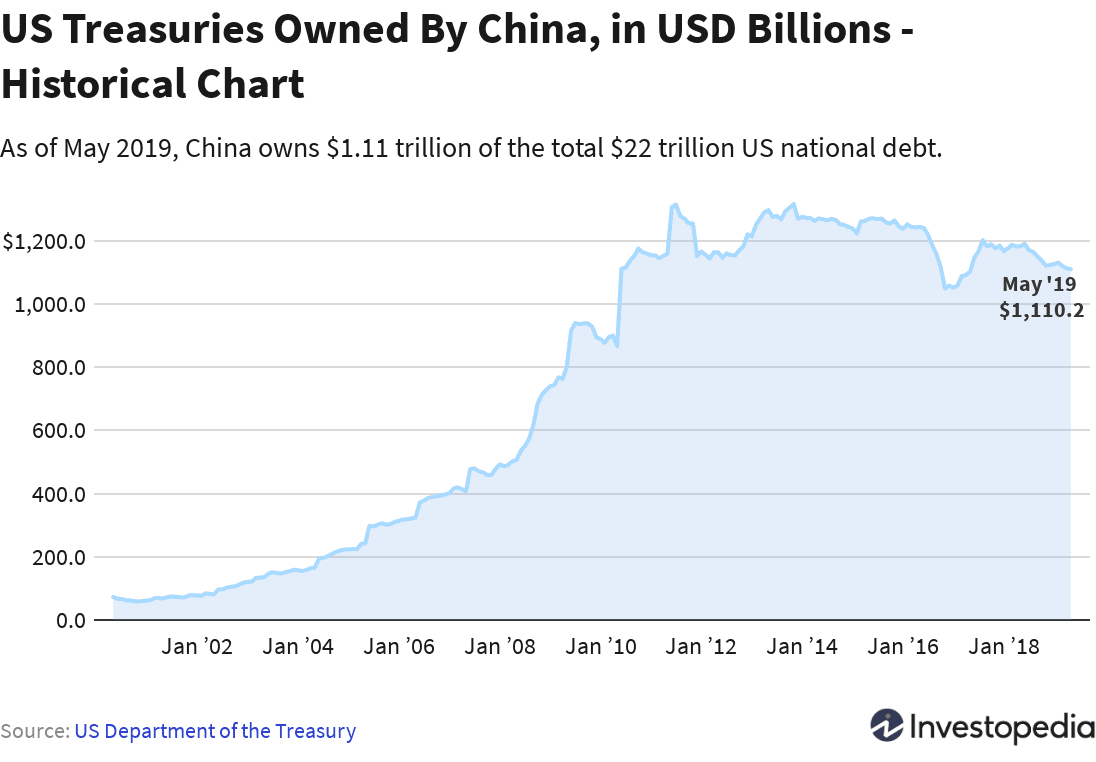

The increased interest comes as chinese bonds were added to major investment indexes that are tracked by global investors, prompting billions of dollars in. The defaulted bond set to mature in april 2024 rose more than 2.4 cents on the dollar to 68.5 cents at 0852 gmt, its highest level since june 2022, according to.

/cloudfront-us-east-2.images.arcpublishing.com/reuters/3RY5LINEFRNOLD3ZKAKJPLIASU.jpg)